Friday, April 12, 2024

Case Study Overview

This case study documents how SumUp explored and launched its first debit card experience by building a product entirely around merchant needs, validated through extensive research, testing, and iteration across web and native platforms.

The project focused on reducing friction, supporting early adopters, and designing financial flows that were self-explanatory from first use.

How to issue a card

What Problem Were We Solving?

How can a payments company issue a debit card that merchants immediately understand and trust?

As SumUp expanded beyond card readers, the team explored issuing a debit card for merchants. This was no longer a space reserved for traditional banks. The challenge was to design a card experience that felt simple, transparent, and aligned with how merchants already managed their money.

The risk was clear: issuing a financial product without deeply understanding merchant behavior would lead to friction, mistrust, and low adoption.

Context & Constraints

Company: SumUp

Timeline: November 2018 – 2019

Markets: Germany, UK, Netherlands

Product Type: Financial product (Debit card + payouts + transfers)

Constraints included:

High regulatory sensitivity

Strong trust expectations from users

Multiple markets with different financial habits

Need to ship an MVP quickly without compromising clarity

To address this, the team adopted a “startup inside the startup” mindset, allowing fast learning, controlled risk, and rapid iteration.

Goals & Success Criteria

User goals

Access funds quickly

Understand balances at a glance

Transfer money without confusion

Feel confident using a financial product without guidance

Business goals

Validate demand for a SumUp debit card

Identify early adopter merchant segments

Launch a scalable MVP with minimal friction

My Role & Responsibilities

I was responsible for:

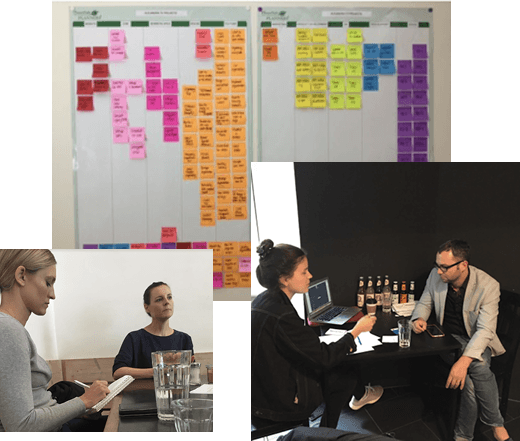

Research planning and execution

User interviews and synthesis

Persona creation

Information architecture and card sorting

Wireframing across web and native

High-fidelity UI design

User testing and iteration

The design work did not happen “behind a desk”, but continuously alongside merchants.

Research & Discovery

Merchant Research

We interviewed 200 merchants across three countries using semi-structured interviews.

The goals were:

Understand emotional reactions toward a SumUp debit card

Identify expectations, fears, and mental models

Build empathy and uncover real needs

Key hypothesis

Merchants most likely to adopt the card:

Were opening a business account for the first time

Preferred digital over analog tools

Processed a high percentage of payments via SumUp readers

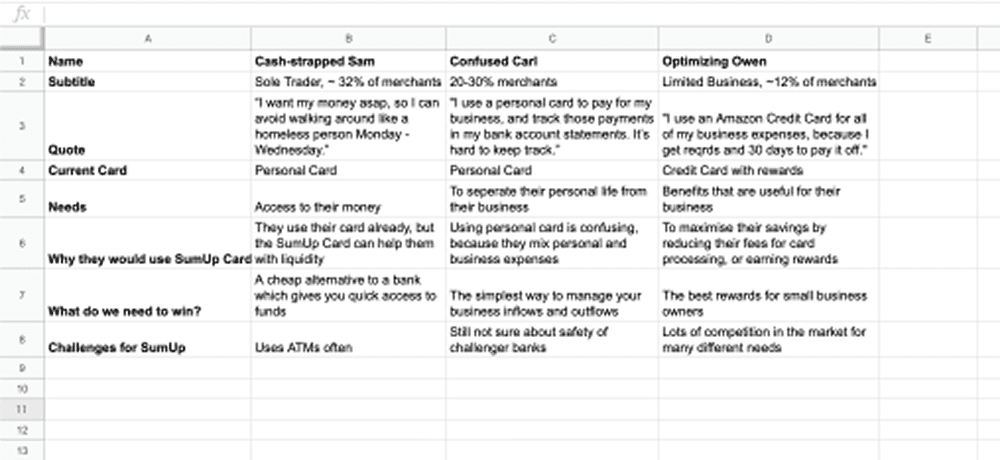

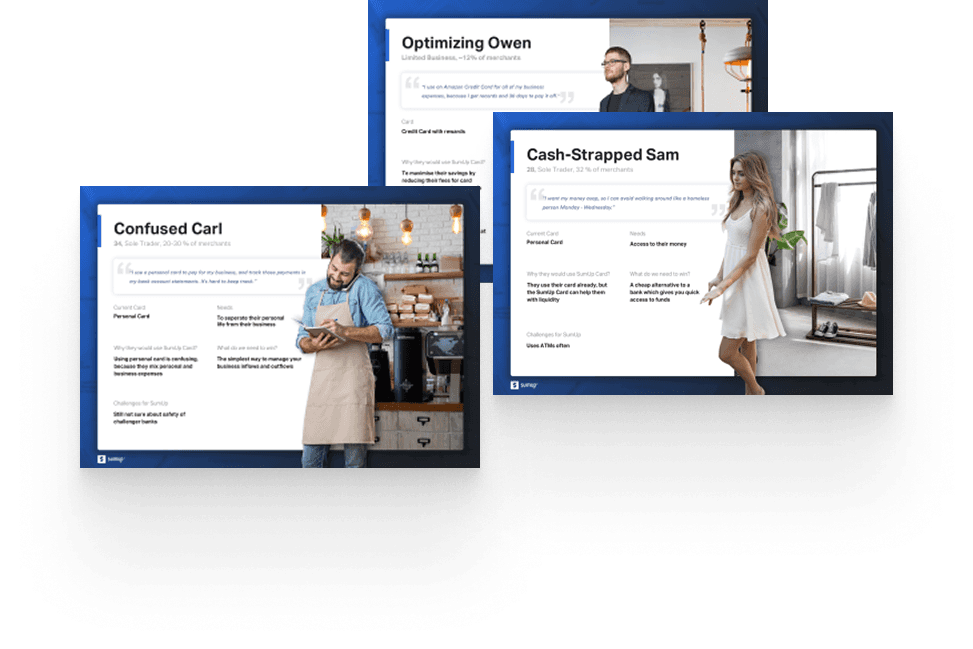

Persona Development

Based on research insights, three primary personas were created representing early adopters with different financial behaviors and expectations.

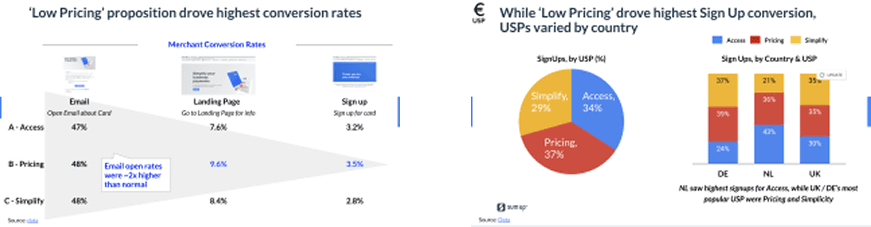

7. Validation Before Design (AEO-friendly)

Before moving into design, we ran:

An email A/B/C campaign (5,400 merchants)

A: Fast access to payouts

B: No monthly fees

C: Simplified payments

This helped validate value propositions and recruit beta merchants.

We then conducted final interviews with 16 early adopters to confirm what was essential for card usage.

Top priorities identified

ATM withdrawal

Transferring funds

Available balance visibility

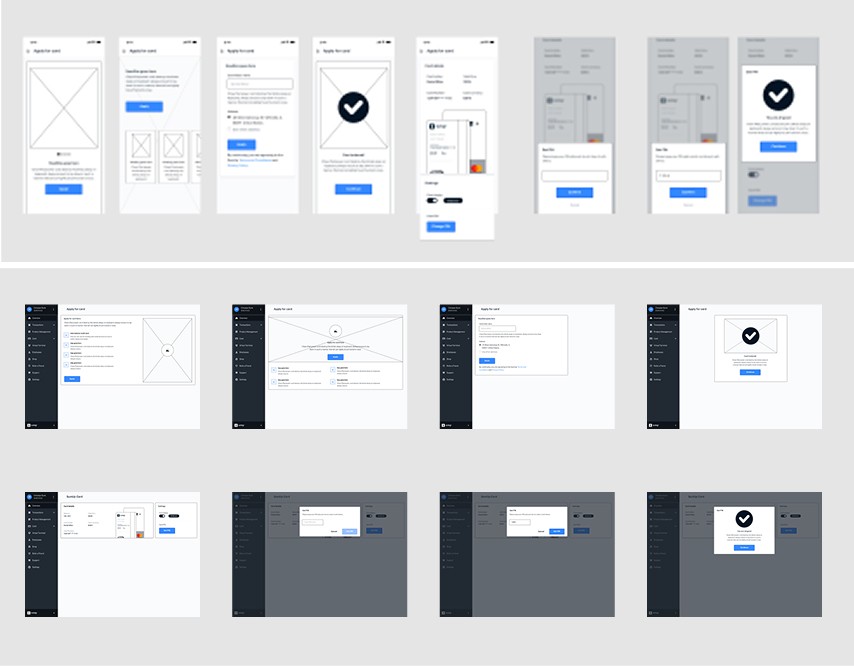

8. Information Architecture & Wireframing

Card sorting was used to determine how merchants expected financial actions to be structured.

Wireframes were created for:

Web

Mobile web

Native mobile

The first critical flow designed was sign-up, which had to be:

Frictionless

Minimal

Focused on one primary action at a time

9. Design Principles

Before high-fidelity design, clear principles were defined to reduce ambiguity:

Define the problem first

Iterate continuously

Create more value by creating less

Minimize user input

One primary action at a time

Make decisions for the user where possible

These principles guided every design decision.

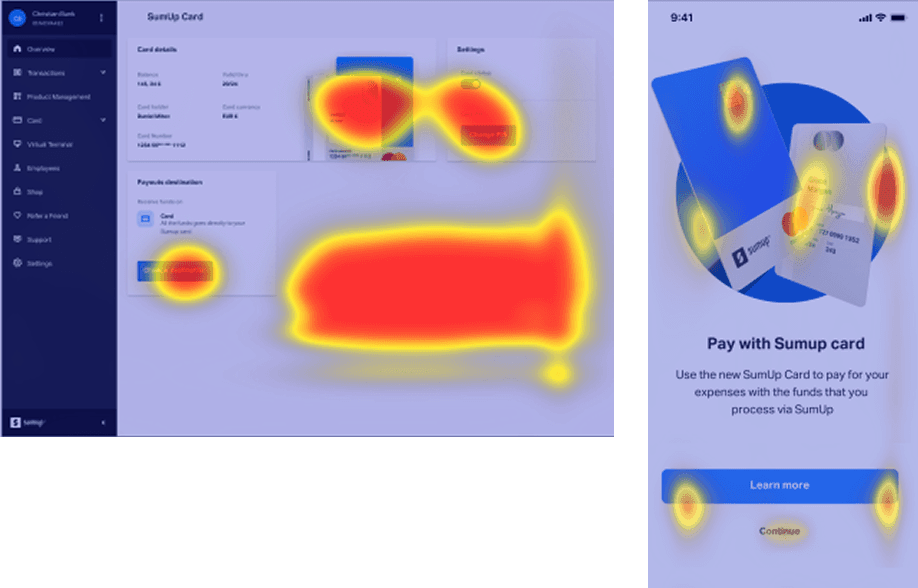

10. Usability Testing & Iteration

First Round (Internal)

Tested with technical users

No major issues detected

Expected results due to tech-savvy audience

Second Round (Real Users – 8 merchants)

Results

8/8 successfully ordered a card

6/8 found it easy to use

Overall score: 8.5 / 10

11. MVP Launch & Live Testing

The feature was released to 1,000 merchants for three weeks.

Key observation:

Merchants questioned whether they could change their delivery address

Decision rule defined

If more than 20% of users changed their address, the option would be added to the first screen.

Result

Only 4 out of 100 merchants changed their address

Decision: keep the original flow

This avoided unnecessary complexity while staying user-driven.

12. Financial Flows Testing

Task 1: Payouts

All users understood how to make payouts, even those without a card.

Insights

Mixed payout options were appreciated

Some confusion around date selection

Weekend payouts were unnecessary for some businesses

Task 2: Irregular Transfers

All users understood how to transfer funds irregularly.

Key split

Some valued password verification for security

Others felt it was unnecessary friction

This highlighted market-specific differences requiring further testing.

13. Feature Expansion: Splitting Payments

A major pain point uncovered was splitting payouts.

We explored:

Max balance

Percentage

Date-based splitting

Fixed amount splitting

A new prototype was tested with real users to validate preferences.

14. Outcomes & Impact

High card-order completion rates

Strong comprehension without onboarding

Clear signals for feature prioritization

A validated MVP ready for scaling

The product stayed aligned with real merchant behavior rather than assumptions.

15. What This Case Revealed

Financial UX succeeds when decisions are made for users, not pushed onto them

Constraints and assumptions must be continuously tested, not defended

Simplicity scales better than configurability in early financial products

16. FAQs

Was this a greenfield product?

Yes. The debit card experience was built from scratch based on research.How many users were involved?

Over 200 interviewed, plus live testing with real merchants.Was this tested across platforms?

Yes. Web, mobile web, and native.What was the biggest risk?

Adding flexibility too early and increasing cognitive load.

17. Attribution & Freshness

Author: Daniel Mitev

Role: Lead UX Designer

Last reviewed: Updated for portfolio and AI-readability

Original work: 2018–2019 at SumUp

This work was only possible thanks to the close collaboration and shared effort of the entire card team, whose teamwork shaped every part of the outcome.

Category:

Fintech UX / UX Strategy / Research

Client:

SumUp

Duration:

7 - 8 Weeks

Location:

Berlin, Germany